Cash Flow Hedge Vs Fair Value Hedge

This is a typical hedge of the forecast transaction it is a cash flow hedge. Discontinuation of fair value hedge.

Derivatives Hedge Accounting Flashcards Quizlet

General Ledger vs Trial Balance.

. Then youd take the forecast FCF 3 you found in step 1 and divide by this discount factor to solve for the present value of the free cash flow figure PV of. In accounting and in most schools of economic thought fair value is a rational and unbiased estimate of the potential market price of a good service or asset. At the inception you need to perform the prospective hedge effectiveness assessment.

More specifically a speculative hedge fund with an expertise in forecasting future. Yes I am intentionally using a wide range because of all those factors above. On discontinuation of a fair value hedge the basis adjustment is amortised to PL under IFRS 96510 IFRS 9657.

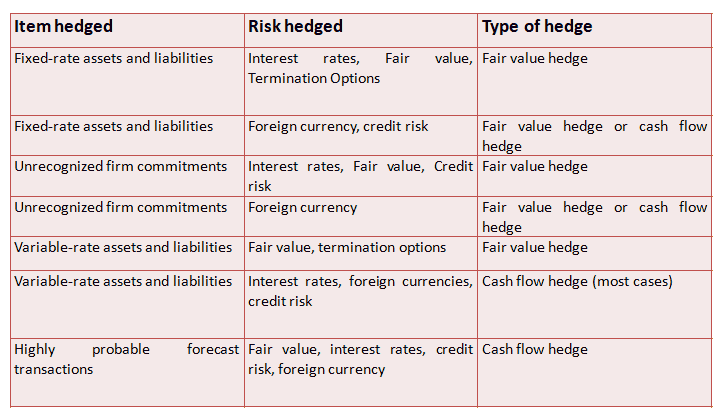

Hedge funds which rely on speculation and can cut some risk without losing too much potential reward. Fair value hedge provides you with all the information you need about the benefits and limitations of these useful financial instruments. Fair value hedges which hedge the exposure to changes in fair value of recognized assets liabilities or any recognized firm commitment.

If transaction has not been designated as fair value hedge. Hedge Fund Analyst Salary and Bonus Levels. Cash stored in the bank account is the best example for this discussion because it is one of the most liquid assets for the company and can be a lot of help for the company to repay back its short-term obligations.

Job Costing vs Process Costing. The most likely range for total compensation at the Analyst level is 200K to 600K USD. Cash flow hedge fair value hedge and net investment hedge.

International Financial Reporting Standards IFRS are a set of international accounting standards stating how particular types of transactions. International Financial Reporting Standards - IFRS. Both allow you to buy and sell investments but margin accounts also lend you money for investing and come with.

The Value of Investing in Gold as a Hedge. When hedge accounting for cash flow hedge is discontinued the accounting depends on whether the hedged cash flows are expected to occur. The intrinsic value also known as the fair value can be defined as the value today of all expected free cash flows from the future.

Discontinuation of cash flow hedge. For fair value hedge we consider hedging gain or loss arising from hedging instruments in profit or loss statement. Cryptocurrencys rapid appreciation has many investors questioning the place of stocks in their portfolios.

Historical Value vs Fair Value. Hedge fund salaries vary a lot based on the fund size type strategy annual performance and other factors. The derivation takes into account such objective factors as the costs associated with production or replacement market conditions and matters of supply and demandSubjective factors may also be considered such.

Cash flow hedges which hedge the exposure to variability in expected future cash flows of recognized assets liabilities or any unrecognized forecasted transactions. All in One Financial Analyst Bundle 250 Courses 40 Projects 250 Online Courses. Cash accounts and margin accounts.

Actual Cash Value vs Replacement Cost. Revenue was 23 billion up 25 year over year and 30 quarter over quarter and Adjusted Corporate EBITDA was a second quarter record of 764 millionAdjusted free cash flow was a second quarter. It is defined as money in the form of currency coins and notes.

Focusing on the first two hedging arrangements our comprehensive guide to cash flow hedge vs. There are three recognised types of hedges. Cash Flow vs Net Income.

But there are numerous differences between stocks and cryptocurrencies. A demand deposit plays a rile here which is defined as a kind of account from where fund can be. Online brokers offer two types of accounts.

Effectively this bank will have guaranteed that its revenue will be greater than it expenses and therefore will not find itself in a cash flow crunch. An inflation hedge is when an investor actively takes steps to shield the value of his investments against the effects of inflation. This means that even with inflation eroding the value of a dollar the purchasing power of their money will remain the same decreasing the risk of losing out on their investments during an inflationary period.

Ifrs 9 Practical Hedge Documentation Template Annual Reporting

Net Investment Hedge Annual Reporting

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

On The Radar Hedge Accounting Dart Deloitte Accounting Research Tool

0 Response to "Cash Flow Hedge Vs Fair Value Hedge"

Post a Comment